This is a brief summary of findings about the Tax Cuts and Jobs Act with a look at statements about the bill and voter impact of seeing the tax provisions. Findings are based on recent listening sessions with voters, and the January 7-10 survey of 1200 voters.

Key Takeaways

- Views of the Tax Cuts And Jobs Act were a slight positive but with large numbers of undecideds. This was also the case among Republicans. Republicans were moved positively by the messaging, with independents being moved only after seeing the list of expiring provisions. This means there needs to be a different communications approach for Republicans and independents.

- Among voters who said they did receive a tax cut from the law, support for the provisions was much higher (68%) than among those who said they did not (33%) or did not know (29%).

- The three statements in favor of extending tax provisions that were the strongest:

- Washington never returned to pre-COVID spending levels of less than 4.5 trillion a year. Starting in 2020, government spending levels every year have topped more than 6 trillion dollars. Until government spending is addressed, Washington shouldn’t be taking more money from taxpayers (65-9 believe-do not believe).

- When the tax rate is lowered, businesses can invest more in their communities, lower costs for consumers, and create jobs. (60-20). An important distinction here is that, as we heard in the focus groups, people were skeptical that businesses would do this and follow through. But in terms of their ability to do good things with lower rates, this is a believable statement.

- People are still recovering from the COVID-19 pandemic and inflation. Renewing the tax provisions will help keep money in people’s pockets to manage inflation and cover household expenses. (58-21)

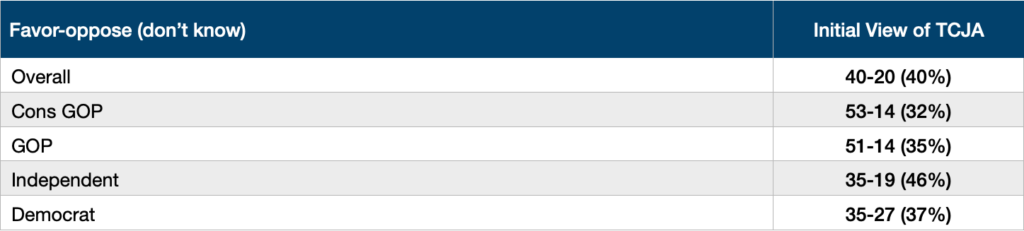

Views Of TCJA

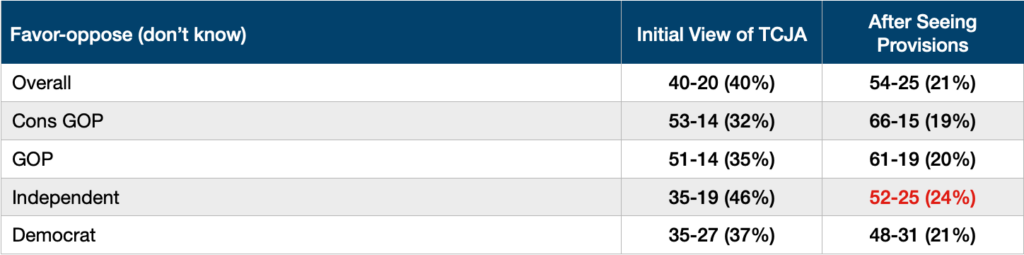

The initial view of the tax law1 was a slight positive (40-20 favor-oppose) but with a sizable percentage of undecided (40%). Among Republicans, views are favorable (51-14) but with a large percentage of undecided (35%). This is also the case among conservative Republicans (53-14, 32% don’t know).

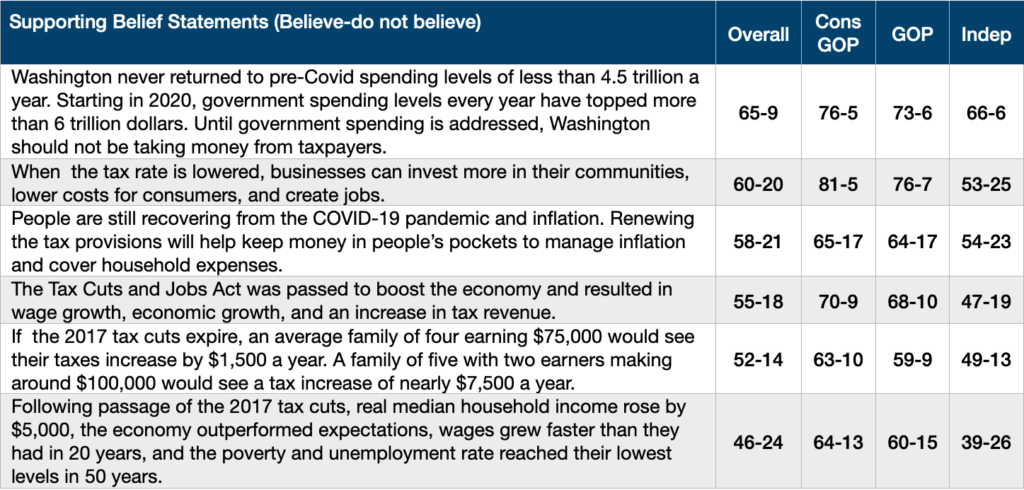

Supporting Statements

We presented a series of supporting and opposing statements for renewing the tax provisions. The statements in support of renewing the TCJA provisions were more believable than opposing statements, and all but one statement reached over 50% believing it.

The three statements in favor of extending tax provisions that were the strongest:

- Washington never returned to pre-COVID spending levels of less than 4.5 trillion a year. Starting in 2020, government spending levels every year have topped more than 6 trillion dollars. Until government spending is addressed, Washington shouldn’t be taking more money from taxpayers (65-9 believe-do not believe). This was an effective statement for the Republicans and independents, who felt it was a demonstrably true statement.

Independent: Definitely number three. “Washington has never returned from pre-Covid spending levels.” And, “ever since 2020, government spending levels have topped more than $6 trillion.” I believe that more than anything because I can see it happening.

- When the tax rate is lowered, businesses can invest more in their communities, lower costs for consumers, and create jobs. (60-20). An important distinction here is that, as we heard in the focus groups, people were skeptical that businesses would do this and follow through. But in terms of their ability to do good things with lower rates, this is a believable statement.

- People are still recovering from the COVID-19 pandemic and inflation. Renewing the tax provisions will help keep money in people’s pockets to manage inflation and cover household expenses. (58-21). This was also an effective statement in the focus groups.

Republican: Raising taxes during a period of inflation certainly won’t help the economy.

Democrat: People are still trying to get back on their feet, still trying to figure things out.

However, as we heard in the listening sessions, other statements elicited a positive response. For example, the statement if the 2017 tax cuts expire, an average family of four earning $75,000 would see their taxes increase by $1,500 a year. A family of five with two earners making around $100,000 would see a tax increase of nearly $7,500 a year (52-14).

Independent: People work so hard, mothers and fathers. And here’s a family of five with the two parents earning a hundred thousand, which is a decent salary, you would think. And then their taxes are going to increase to $7,500.That kind of takes the wind out of your sails.

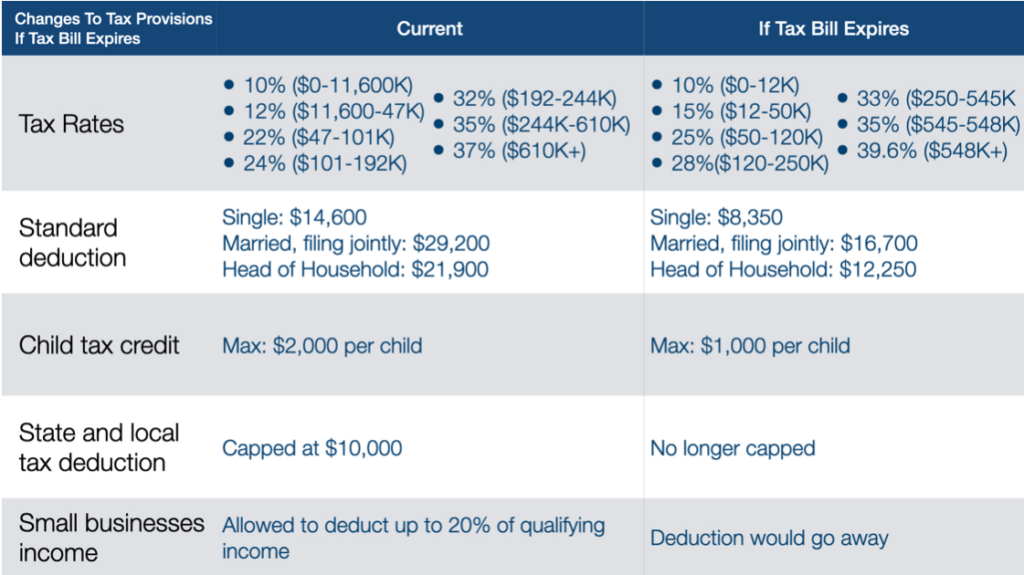

Provisions of the Bill

Following the messaging, we showed voters a list of certain provisions that would expire and what the impact would be, which was the same list we used in the listening sessions.

Participants were alarmed at the personal impact of the provisions expiring.

Republican: It would kill me.

Republican: The standard deductions are something that jump out at me. I’m a single person, and $14,000 down to $8 [thousand]. I don’t frankly make a ton of money in my small business.

Independent: I’m looking at the deduction and that’s pretty bad. … [The] child credit’s going down. I know I have friends that are pregnant with their first kid coming in. People are complaining about childcare, thousands of dollars just to, just to keep a kid in daycare. And to know that you’re losing out on an extra thousand dollars, from taxes. Small businesses. I think that’s a huge hit there. You’re not able to qualify for a deduction. So, yeah, I see nothing but bad things here.

Impact Of Provisions

After seeing the provisions, views in the listening sessions and on the survey shifted more positively, especially among independents (from 35% support to 52%) and even Democrats (from 35% support to 48%).

This indicates that outside the Republican base, there should be more of a visual approach to clearly display the provisions’ impact.

Republican: These figures really shift my opinion. I was moderately opposed to the change. Now, I’m very strongly opposed to the change after looking at these figures, the impact on people who are middle or lower income in those brackets, the impact will be significant.

Republican: I wasn’t aware of all the details of the proposed changes, but to me it’s very clear that keeping the current setup is beneficial to most people than not. … I want to know if I’m in favor of keeping this, why the heck politicians aren’t using this to their advantage?

Democrat: I would probably opt to extend them just because this would have like a direct effect on me and people in my immediate circle.

Perceptions About Whether Voters Received A Tax Cut

Before seeing the provisions, about a third of voters believed the statement most Americans got a tax cut from the Tax Cuts and Jobs Act passed in 2017 (32-37 believe-do not believe, 31% don’t know). Only 43% of conservative Republicans (43-28), 41% of Republicans overall (41-30), 28% of independents (28-38), and 27% of Democrats believed this statement (27-42).

Independent: I don’t think most Americans got a tax cut. I really don’t.

After seeing provisions, 44% of voters said that the tax plan did lower taxes for people like them (44-39 did-did not), including 57% of conservative Republicans (57-30), 53% of Republicans overall (53-34), 43% of independents (43-38). Only Democrats still said that the the plan did not lower taxes for people like them (37-46).

In a direct question (Did you get a tax cut from the Tax Cuts and Jobs Act passed in 2017?) only one in four — 24% of the electorate — said yes (24-51 yes-no). This included only 30% of Republicans (30-46), 34% of conservative Republicans (34-42), 23% of independents (23-52), and 20% of Democrats (20-54).

Among voters who said they did receive a tax cut from the law, support for the provisions was much higher (68% favor) than among those who said they did not (33% favor) or did not know (29% favor).

- Description: In 2017, Congress passed the Tax Cuts and Jobs Act that implemented several changes to our tax code. At the end of 2025, some of the provisions from the 2017 bill are expiring, and Congress must decide whether to renew those provisions or allow them to expire. Do you favor or oppose renewing those tax provisions?

↩︎

For more of our Tax Tools, click here.