This is a brief summary of findings about the US fiscal outlook and the electorate’s beliefs about the national deficit and debt. Findings are based on recent listening sessions with voters, and the January 7-10 survey of 1200 voters.

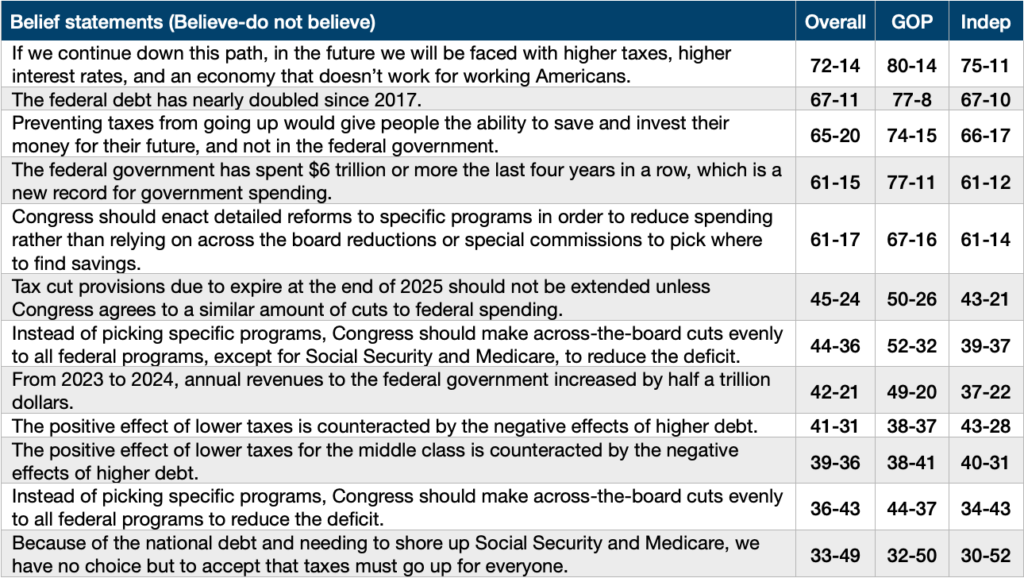

Statements about debt/deficit were believable to voters.

- If we continue down this path, in the future we will be faced with higher taxes, higher interest rates, and an economy that doesn’t work for working Americans. (72-14 believe-do not believe)

- The federal debt has nearly doubled since 2017. (67-11)

- Preventing taxes from going up would give people the ability to save and invest their money for their future, and not in the federal government (65-20).

- The federal government has spent $6 trillion or more the last four years in a row which is a new record for government spending. (61-15 believe-do not believe)

The chart below shows belief statements ranked highest to lowest with the most believable statements at the top, and least believable statements at the bottom.

Although there is concern about the deficit, people do not accept that taxes should go up for everyone even in the context of entitlement programs: Because of the national debt and needing to shore up Social Security and Medicare, we have no choice but to accept that taxes must go up for everyone (33-49 believe-do not believe). This statement is not believed by voters of any partisan affiliation (Republicans 32-50, independents 30-52, Democrats 36-44). Focus group participants also did not believe that taxes would have to go up for everyone, feeling that while taxes on higher income earners might be acceptable, raising taxes on lower and middle income earners would not be possible. This is a significant obstacle for advocates of tax increases.

For more of our Tax Tools, click here.