This is a brief summary of findings about government spending and revenue with a look at how voters evaluate tax increases and spending cuts as debt solutions. The research is based on recent listening sessions with voters and the January 7-10 survey of 1200 voters.

Key Takeaways

- In terms of debt solutions, spending cuts and tax increases are not on equal footing. Voters want government spending to be addressed first, as they do not believe they should be penalized for the government’s overspending. Voters have not ruled out tax increases, but this is seen as a last resort rather than first option.

- As a result, voters do not accept that taxes should go up for everyone even in the context of entitlement programs.

Spending and Revenue

Generally speaking, voters found statements about the debt and deficit — including about the negative consequences of not addressing the debt and deficit — to be believable, and did not accept the argument that taxes needed to go up to shore up entitlement programs. They overwhelmingly believed that the problem was one of too much spending, rather than not enough revenues. This echoed the comments we heard in the focus groups about the government’s spending and the present fiscal situation.

Republican: It’s definitely a spending problem. I mean, we’d never had a year where we took in $4 trillion until the last like three years. So we’re taking in more taxes than ever and they’re spending twice as much money as we’re taking in anyway.And they’ve got all the money they want. … They’ve got all the money they want for what they want to do.

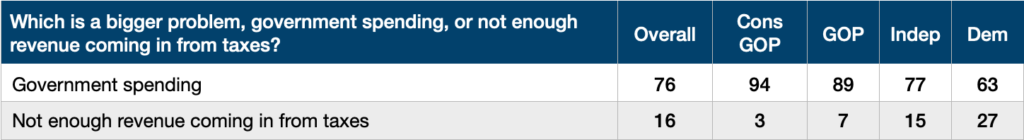

In a direct choice, government spending was overwhelmingly seen as a bigger problem (76%) than not enough revenue coming in from taxes (16%). This is the case across party (Republicans: 89-7; Independents 77-15; Democrats 63-27).

In the listening sessions, participants also saw the problem as primarily one of too much spending rather than not enough revenues, although many respondents, particularly the independents, said that both could be true.

Independent: I think it’s just a little bit of both.

Independent: [The government doesn’t] have enough money to come in to cover all the stuff that they need to cover.But there again, at the same time, it’s their own fault because it’s, like I said earlier, there’s a lot of stuff that government’s into that they shouldn’t be into and that’s where a lot of the revenue is wasted.

Washington Never Returned To Pre-Covid Spending Levels

One of the most believable statements in the research was that Washington never returned to pre-COVID spending levels of less than 4.5 trillion a year. Starting in 2020, government spending levels every year have topped more than 6 trillion dollars. Until government spending is addressed, Washington shouldn’t be taking more money from taxpayers (65-9 believe-do not believe). This was an effective statement for the Republicans and independents, who felt it was a demonstrably true statement.

Independent: Well, definitely number three. “Washington has never returned from pre-Covid spending levels.” And, “ever since 2020, government spending levels have topped more than $6 trillion.” I believe that more than anything because I can see it happening.

Republican: We definitely have a spending problem more than a tax problem. In fact, we’re taking in more taxes now than we have, if I remember right, than we have ever.

Are Tax Increases Inevitable?

Because of the focus on government spending, voters do not accept that taxes should go up for everyone even in the context of entitlement programs: Because of the national debt and needing to shore up Social Security and Medicare, we have no choice but to accept that taxes must go up for everyone (33-49 believe-do not believe). This statement is not believed by voters of any partisan affiliation (Republicans 32-50, independents 30-52, Democrats 36-44). This is a significant obstacle for advocates of tax increases.

Contributors To The Debt

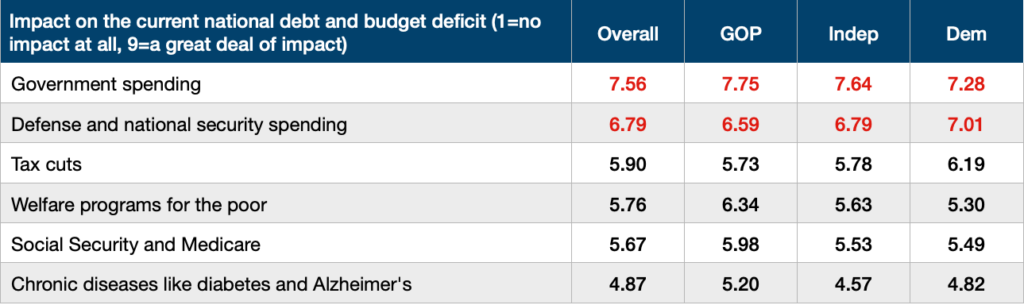

In terms of contributors to the debt, spending was seen as much more of a contributor than tax cuts. On a scale of 1 to 9, where 1 indicated no impact at all, 5 some impact, and 9 a great deal of impact, government spending (mean 7.56) was seen as having the greatest impact on the debt and deficit, followed by defense and national security (6.79). Tax cuts came in third at 5.90. Two of the biggest drivers of the debt (Social Security/Medicare and chronic disease) were last on the list. There is concern about insufficient revenues to meet national priorities.

Across party, government spending and defense/security spending were seen as the top two drivers of the debt. Even among Democrats, spending and defense/security were ahead of tax cuts as debt contributors.

Creating The Right Incentives In Government

As we heard in the focus groups, voters believe spending should be cut, but also that incentives need to be realigned. Right now, they see no incentive for government to perform efficiently, but do not feel that taxpayers should be punished for government overspending.

Democrat: I’m going to say Washington has a spending problem.I think they spend the money on what they want to spend the money on.

Republican: The government needs to look at its own spending. That’s the common denominator here, that every single year, they are in a deficit, somehow, some way. Whether it’s war, whether it’s from whatever. But it’s not the taxpayer’s burden anymore. We’re giving them the money and they’re the ones that are not handling it correctly and spending it frivolously. So, it’s not our problem. They need to fix what they’re doing. It’s not working.

For more of our Tax Tools, click here.