The new year kicks off the tax wars on Capitol Hill, with the TCJA individual tax provisions set to expire at the end of 2025. We have new research on taxes and the debt (a series of focus groups and a national survey of 1200 registered voters conducted January 7-10). Over the coming weeks, we’ll have more resources available on economic issues. Here are some of the highlights:

1.) Inflation was the construct by which people viewed the economy and taxes. As a result, the most important personal outcome from tax policy was helps you deal with inflation and high prices in your household budget (mean 7.52 on a scale of 1-9 with 1 being not important at all and 9 extremely important), followed by creating economic growth (7.39) and greater ability to save for the future and retirement (7.38).

2.) In terms of debt solutions, spending cuts and tax increases are not on equal footing. Voters want government spending to be addressed first, as they do not believe they should be penalized for the government’s overspending. As one voter in our focus groups said, “The government needs to look at its own spending. That’s the common denominator here. Every single year they are in a deficit. … It’s not the taxpayers’ burden anymore. We’re the ones giving them the money, and they are the ones not handling it correctly.”

Voters have not ruled out tax increases, but this is seen as a last resort rather than first option, creating an uphill battle for proponents of tax increases.

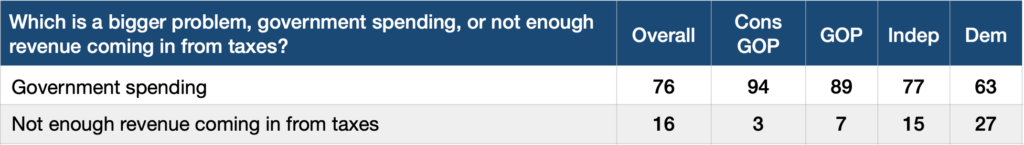

3.) In a direct choice, government spending was overwhelmingly seen as a bigger problem (76%) than not enough revenue coming in from taxes (16%). This is the case across party (Republicans: 89-7; Independents 77-15; Democrats 63-27).

4.) Only one in four — 24% of the electorate — said they received a tax cut from the Tax Cuts and Jobs Act passed in 2017 (24-51 yes-no). This included only 30% of Republicans and 34% of conservative Republicans.

For Republicans and the business community, there are major educational challenges ahead.